7 Easy Facts About Personal Loans Canada Described

7 Easy Facts About Personal Loans Canada Described

Blog Article

The Main Principles Of Personal Loans Canada

Table of ContentsPersonal Loans Canada Things To Know Before You Get ThisHow Personal Loans Canada can Save You Time, Stress, and Money.What Does Personal Loans Canada Do?Things about Personal Loans CanadaThe Ultimate Guide To Personal Loans Canada

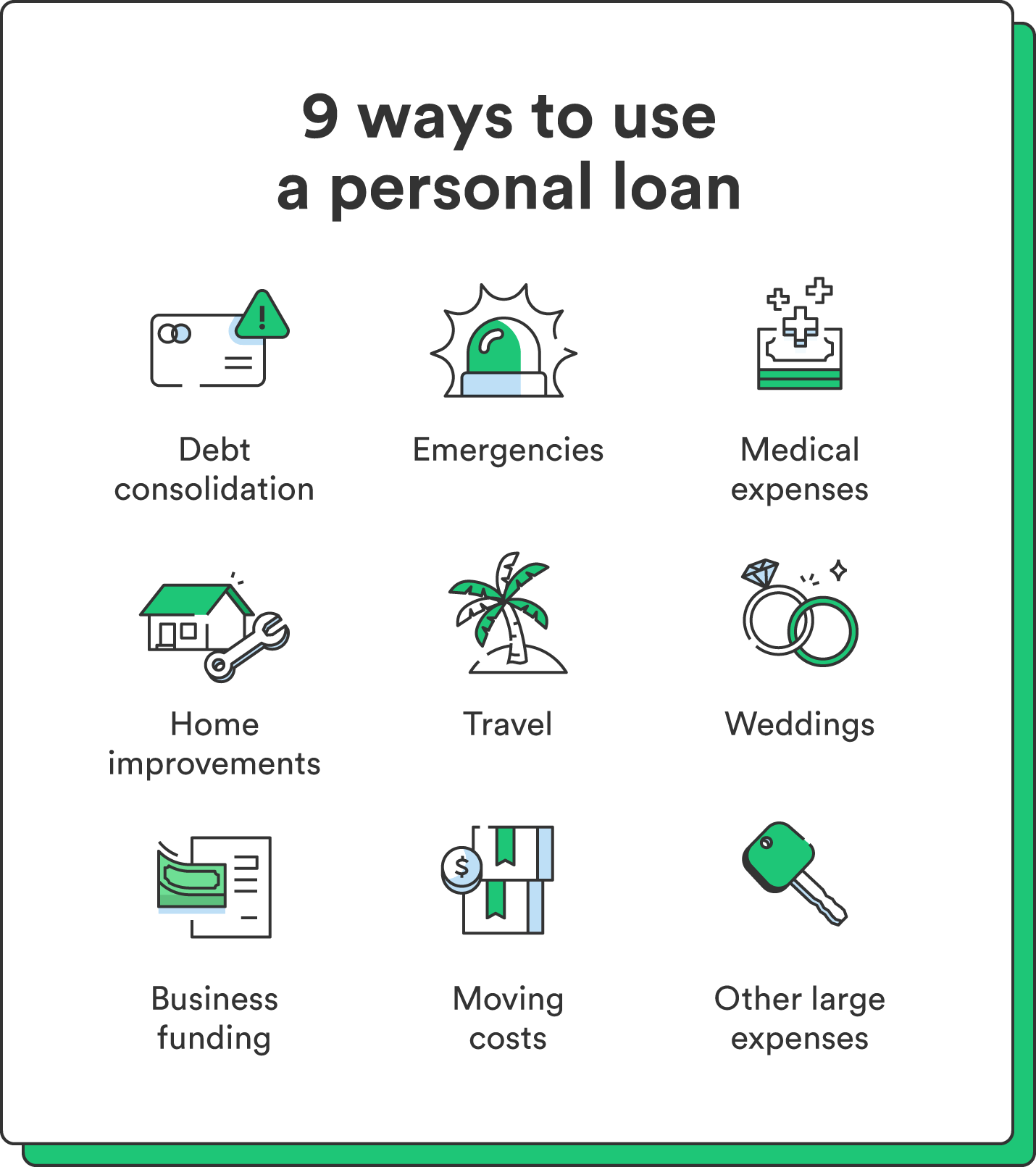

Let's dive right into what an individual funding really is (and what it's not), the reasons people utilize them, and how you can cover those insane emergency expenditures without taking on the worry of financial obligation. An individual lending is a round figure of cash you can borrow for. well, nearly anything., yet that's technically not a personal financing (Personal Loans Canada). Individual car loans are made via an actual economic institutionlike a bank, credit scores union or online loan provider.

Allow's take an appearance at each so you can understand specifically just how they workand why you do not require one. Ever before. The majority of personal lendings are unsafe, which means there's no collateral (something to back the loan, like an automobile or house). Unsafe lendings commonly have greater rates of interest and require a much better credit history due to the fact that there's no physical thing the lending institution can take away if you do not compensate.

Some Ideas on Personal Loans Canada You Need To Know

Shocked? That's okay. Regardless of just how great your credit is, you'll still need to pay interest on a lot of personal finances. There's always a rate to pay for borrowing money. Guaranteed personal loans, on the other hand, have some kind of security to "safeguard" the loan, like a boat, jewelry or RVjust among others.

You can likewise obtain a protected personal financing using your car as collateral. Yet that's an unsafe step! You do not want your major setting of transport to and from work getting repo'ed due to the fact that you're still paying for in 2015's kitchen area remodel. Depend on us, there's nothing secure about guaranteed lendings.

Simply due to the fact that the repayments are predictable, it doesn't suggest this is a good offer. Personal Loans Canada. Like we claimed in the past, you're virtually guaranteed to pay passion on a personal funding. Just do the mathematics: You'll wind up paying way a lot more in the future by taking out a funding than if you 'd just paid with money

The Single Strategy To Use For Personal Loans Canada

And you're the fish hanging on a line. An installation funding is an individual funding you pay back in dealt with installations with check out this site time (generally once a month) till it's paid completely - Personal Loans Canada. And do not miss this: You have to pay back the initial car loan quantity prior to you can borrow anything else

Don't be mistaken: This isn't the same as a credit scores card. With personal lines of credit history, you're paying rate of interest on the loaneven if you pay on time.

This one obtains us riled up. Why? Due to the fact that these organizations exploit individuals who can't pay their costs. Which's just incorrect. Technically, these are temporary finances that provide you your paycheck beforehand. That might seem confident when you're in an economic accident and need some cash to cover your expenses.

The 7-Minute Rule for Personal Loans Canada

Since things get genuine untidy actual quickly when you miss out on a settlement. Those lenders will certainly come after your pleasant granny that guaranteed the loan for you. Oh, and you ought to never guarantee a car loan for anyone else either!

However all you're really doing is utilizing new financial debt to repay old financial debt (and expanding your lending term). That simply suggests you'll be paying much more with time. Firms recognize that toowhich is specifically why a lot of of them provide you loan consolidation car loans. A lower rate of interest does not get you out of debtyou do.

And it starts with not borrowing any even more money. Whether you're assuming of taking out an individual car loan to cover that kitchen remodel or your frustrating credit score card expenses. Taking out debt to pay for points isn't the way to go.

Some Known Factual Statements About Personal Loans Canada

The very best point you can do for your financial future is leave that buy-now-pay-later mindset and state no to those investing impulses. And if you're considering an individual lending to cover an emergency situation, we obtain it. But borrowing cash to spend for an emergency only rises the stress and difficulty of the scenario.

Report this page